Looking at Alternatives and Supplements to Excel

Excel is often called the “Swiss Army knife of software” or the “second-best solu- tion” because you can do practically anything in Excel, but it’s not always the best tool for the job. You can write a letter in Excel for example, but Word is a much better tool for that purpose. You can keep your company accounts in Excel, but a purpose-built general ledger system will deliver a much better result.

Desktop spreadsheets are so popular because they’re easy to use to communicate ideas and strategies in an understandable business model. Working in an analytic role, the spreadsheet actually becomes part of the way people think about busi- ness issues and relationships — the tool shapes the very way you consider your approach. The spreadsheet tool actually becomes a part of the process of the anal- ysis, so you’ll sometimes hear people say, “Let’s get this into Excel and see what it looks like!”

So, what are the other options available? Instead of assuming that Excel is the best tool for financial modeling, you should be aware of the alternatives, as well as some of the add-ins that supplement Excel specifically for the purpose of finan- cial modeling. Here’s a list of some of the alternatives and supplements to Excel. Keep in mind that this isn’t a comprehensive list, and I’m not endorsing any of these products. These are just options worth your consideration:

» Data extraction and analysis: SAS, KNIME, Tableau, and Oracle-based tools are no doubt far more robust and secure than Excel solutions that pull data

from other systems into Excel manually such as macros or Power Query in Excel. These kinds of enterprise-grade solutions are purpose-built for the extraction and analysis of data and are a good long-term solution, but they’re often diffi

to use and they take a long time to implement due to lack of familiarity.

» Planning and performance management: Anaplan and Tagetik are alternate cloud-based options that are designed to replace spreadsheets altogether. These tools off powerful capabilities that support analysts in

forward planning and making confi decisions based on data rather than spending their time correcting errors.

» Excel add-ins for model building: Modano is a modular content manage- ment and sharing platform for Excel, enabling pieces of spreadsheets to be reused, shared, and linked to save time and reduce risk. Its main application is

fi modeling, but it can be used to modularize any spreadsheet. Instead of replacing Excel, Modano improves Excel and combats some of its ineffi – cies and shortcomings. Modano replaces BPM, an older Excel add-in that systemized the implementation and review of spreadsheet best practices.

» Excel add-ins for auditing: Spreadsheet Advantage, Spreadsheet Detective, Spreadsheet Professional, and OAK are Excel add-ins that can help develop and review fi models. They interrogate a spreadsheet in extreme detail

to help identify where you might have an error. The software produces key statistics on any spreadsheet, such as the number of unique formulas, where the formulas can be found across each sheet, and the relationships between sheets. It also produces a map of each cell to indicate whether that cell is a text, number, new, or consistent formula.

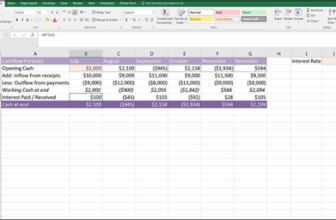

» Dashboards and data visualization: Once you’ve fi building your

fi model, you may like to display the results in a chart or a dashboard.

This can be done on the front sheet of an Excel workbook, in Microsoft Power BI, or using one of hundreds of other purpose-built data visualization and dashboarding tools. One such tool is Modeler, which can transform your model into an app with no coding, using just Excel and PowerPoint. The most popular non-Microsoft tools at the moment are Tableau and QlickView, but this area is growing rapidly. See Chapter 9 for more information about how to present your model output using standard Excel tools.

» Budgeting and forecasting: Many of the models you’ll build are for the purpose of budgeting and forecasting — and then reporting on those budgets and forecasts. Most major general ledger systems have additional modules available

that are built specifi for the purpose of budgeting, forecasting, and reporting. These tools provide a much easier, quicker method of creating budgets and forecasts that is far more robust and less error-prone than using Excel templates. Hundreds of budgeting and forecasting tools are available; some of the most popular are Board, Oracle (JD Edwards), TM1 (Cognos), and Adaptive Insights.

THE CASE FOR EXCEL

So, why do we still use Excel, even though a “better” solution might exist? Here are some

of the reasons:

- Every business already has Excel installed. Your company doesn’t have to pur- chase extra licenses or pay for expensive consultants to install it.

- Little training is needed. Most users have some familiarity with Excel, which means other people will be able to edit, change, and understand your Excel model.

- Excel is very fl You can build almost anything you can imagine in Excel (within size limitations, of course).

- Excel “talks” to other systems very well. With Excel, you can report, model, and contrast virtually any data, from any source, all in one report.

- Most important, Excel is commonly used across all industries, countries, and organizations. This means that the Excel skills you already have, and the skills you’ll hone by reading this book, are highly transferrable. You can use those skills in

other jobs at other companies no matter where your career takes you. Sure, there are thousands of other pieces of software that you can learn, but I believe that for a career in fi one of the best things you can do for your career is to improve your Excel skills.

Of course, I can’t predict the future, but it’s diffi to imagine a world where Excel is not the dominant fi software.

IN THIS CHAPTER

» Determining and designing the problem that the fi model needs to solve

» Looking at the diff between two courses of action using scenario analysis

» Working with and extrapolating time

series data